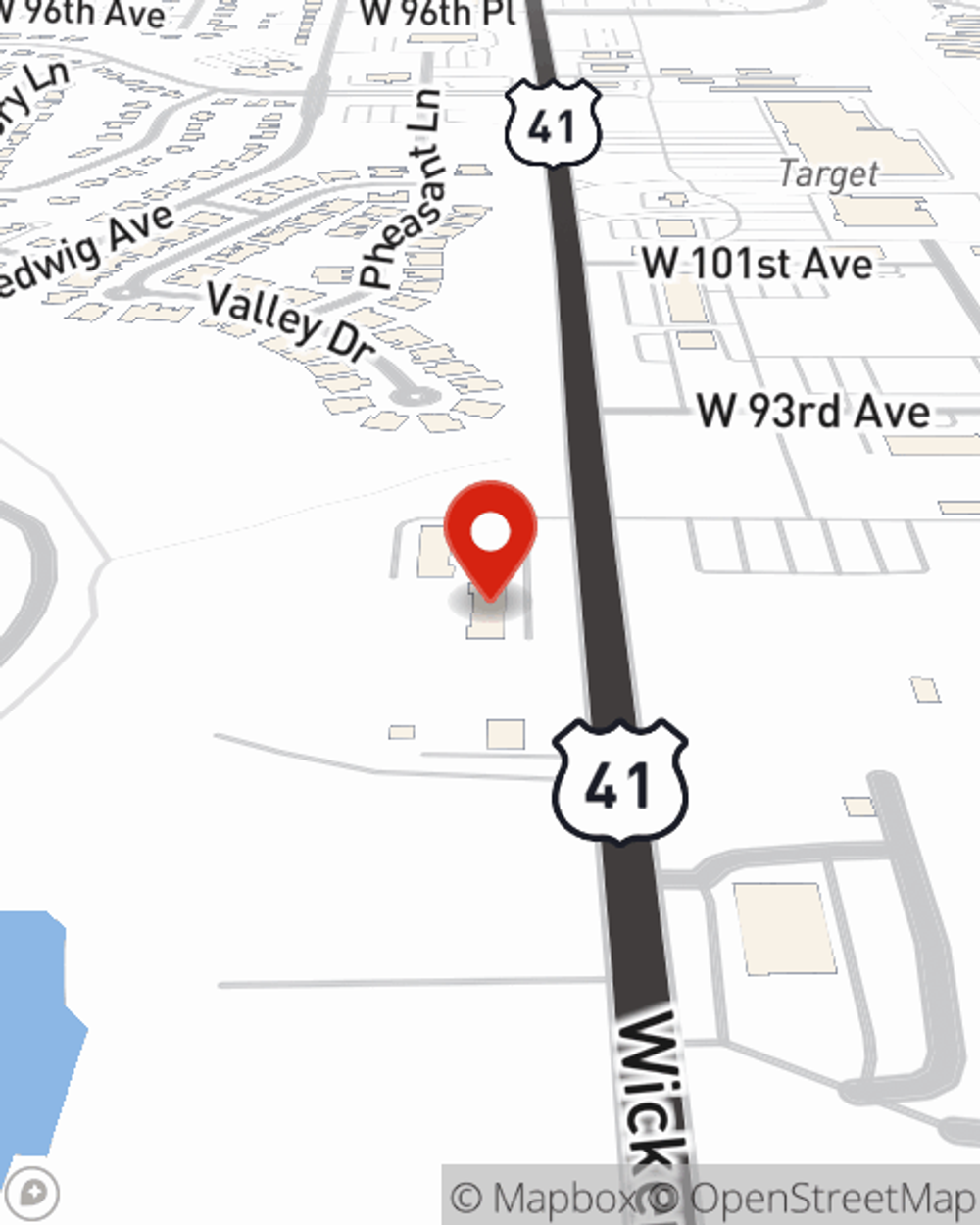

Renters Insurance in and around St. John

St. John renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

- St. John

- Saint John

- Dyer

- Cedar Lake

- Schererville

- Crown Point

- Lowell

- Crete

- Beecher

- Lake County, IN

Home Is Where Your Heart Is

The place you call home is the cornerstone for everything you cherish. It’s where you build a life with family and friends. Home is truly where your heart is. That’s why, even if you live in a rented apartment or home, you should have renters insurance—whether or not your landlord requires it. It's coverage for the things you do own, like your silverware and fishing rods... even your security blanket. You'll get that with renters insurance from State Farm. Agent Ryan Spangler can roll out the welcome mat with the knowledge and skill to help you make sure your stuff is protected. Skilled care and service like this is what sets State Farm apart from the rest. When you're covered by State Farm, your rental can be home sweet home.

St. John renters, State Farm has insurance for you, too

Rent wisely with insurance from State Farm

Renters Insurance You Can Count On

Renters rarely realize how much money they have tied up in their possessions. Just because you are renting a townhome or condo, you still own plenty of property and personal items—such as a tool set, tablet, bed, and more. All of these have value, which would be a real loss if damaged or destroyed. That's why you need renters insurance from State Farm. Why buy your renters insurance from Ryan Spangler? You need an agent committed to helping you evaluate your risks and choose the right policy. With efficiency and skill, Ryan Spangler is waiting to help you keep your things safe.

Get in touch with Ryan Spangler's office to see the advantages of State Farm's renters insurance to help keep your personal property protected.

Have More Questions About Renters Insurance?

Call Ryan at (219) 627-3996 or visit our FAQ page.

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Ryan Spangler

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.